Many high-end collectibles now fall within the category of an alternative asset class. The same money that could be invested in stocks and bonds is ending up high-end collectibles. Not all collectibles are created equal, but even the nation’s largest banks and financial institutions are continuing to notice alternative assets within the wide field of collectibles.

Bank of America has published its study of younger investors turning to alternative investments in NFTs and other cultural collectibles to help their long-term wealth strategies. According to BofA’s private bank study, some 75% of young investors (21-42) believe that it is impossible to achieve above-average returns solely with the traditional investments into stocks and bonds. That said, the BofA study also points out that half of parents do not believe their children are prepared to handle family money and they are waiting until their late-20s to start the conversation about wealth transfers.

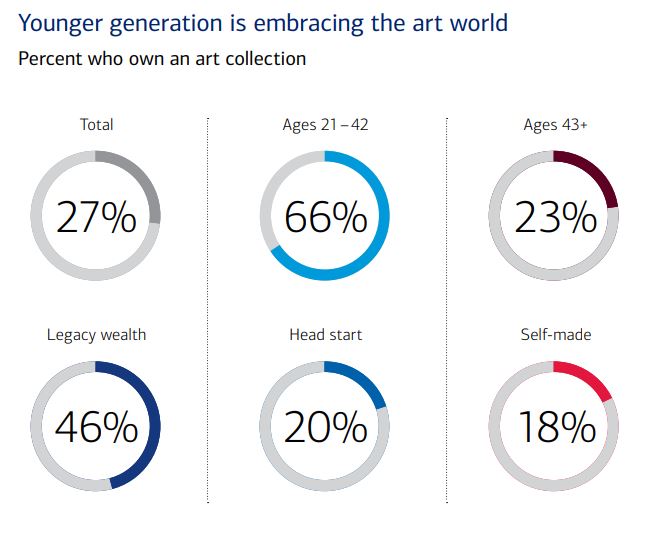

A significant issue now is that some $84 trillion is expected to pass down from baby boomers to Gen X and millennials through the year 2045. Conversely, only 32% of investors over age 43 believe it is not possible to achieve above-average returns investing in just stocks and bonds. Image source BofA.

BofA’s study also shows that 80% of young investors (21-42) are looking to alternative investments like private equity, commodities, real estate, and other tangible assets. The study shows that the younger investors are allocating 3-times more of their investment portfolios to alternative strategies (16%) and half as much to stocks (25%) than older investors (5% and 55%, respectively). Among investors 43 and older, this group maintains that U.S. equities offer the best opportunity for growth in the future.

It is probably without surprise that younger investors are more focused on sustainability. The BofA study showed:

Ownership of sustainable investments have doubled since 2018, from 12% to 26% of wealthy people. Nearly three-quarters (73%) of millennials compared to 21% of older respondents use sustainable investments, which 72% of all survey respondents agree can make a positive impact in the world.

The study further points out that art is its own alternative asset class. While 63% of art owners collect for the aesthetic value, only about 9% plan to sell art quickly for profit. These are some of the dynamics pointed out directly as a dynamic market:

- 60% of art collectors have purchased a piece in the past 12 months.

- 58% plan to sell a valuable work in the next 12 months.

More detailed results from the BofA Private Bank study showed that art isn’t just for the young as 8 in 10 wealthy people have said they are likely to buy a valuable work of art — and roughly half are doing it for the investment opportunity. That said, only 12% of respondents agreed that valuable art is “a sign of my wealth and success.”

Categories: Digital& NFT, Fine Art