Many collectors also invest in collectibles and related assets that they know and understand. New York-based shares of the UK-base Manchester United plc have seen a lot of action lately. This may even be more action than Cristiano Ronaldo’s most coveted rookie and limited edition soccer cards. It turns out that Ronaldo has been a gift that keeps on giving to those investors who are “collecting Manchester United shares.” At least until this week — and that “at least” has to do with the owners of the club rather than Ronaldo himself.

This is an instance where investors may be collectors, and also where collectors may be investors. After all, this is big money we are talking about here. After all, collectors had a lot of risk/reward around key player contract negotiations.

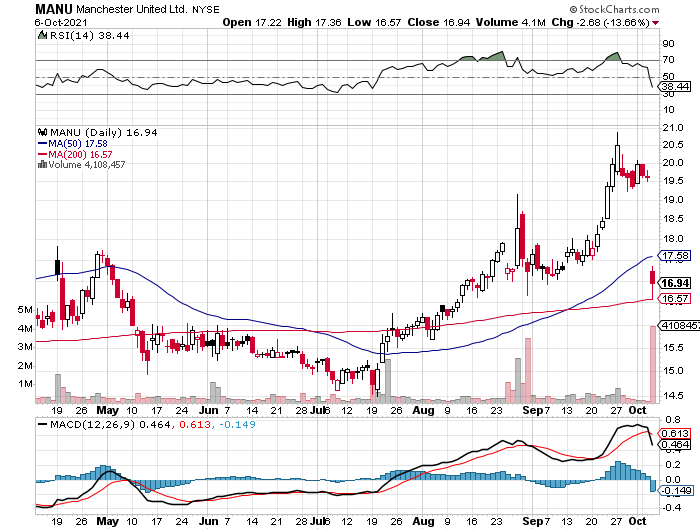

When news broke on August 27, 2021 that Ronaldo was returning to Manchester United, the New York-listed shares shot up from about $17.50 to be above $19.00 briefly. The stock didn’t do very much after that and it settled back in, but after the earnings report and outlook issued the shares shot to just above $20.00. That was up nearly 15%. Then came the news that the Glazers are going to sell 9.5 million listed shares took the stock back under $17.00 on Wednesday’s close.

While Collectors Dashboard generally focuses on collectibles (sports cards and memorabilia in this particular instance), some collectors did rather well buying stock “on the return of Cristiano” for a good quick profit. It is actually easier to day trade and swing trade stocks than it is sports cards when you consider commissions, fees, shipping and taxes.

What investors will call this move, outside of perhaps a “gift,” is that the Glazers just “round-tripped” the stock. That is vernacular for taking it right back to where it started – just like taking a plane ride out and then flying back home. After a 15.2% drop on Wednesday, the New York listed shares closed down $3.04 at $16.94. Even worse, the trading volume of more than 4 million shares was actually stronger volume than when Ronaldo’s new announcement for “the return” — and this was volume to the downside than the upside.

Here is where collectors may want to think about things. It’s not that often that a hot card jumps 15% or falls 15% overnight in player cards that are already considered GOATs (greatest of all-time). For a GOAT card to fall 15% overnight it would require a severe scandal or a sudden embarrassing event.

Using technical analysis and historic lessons of a drop would put the risks high that a drop of this magnitude on this much volume signals more weakness ahead. It’s a general rule of thumb, not set in stone. That said, the 9.5 million shares represents roughly 8% of the Glazers’ combined stake. It also follows Avram Glazer’s stock sale of nearly $100 million in March of this year. That prior sale caused a similar drop in the stock (Call it $20 to $18, or about 10%).

This part of the sale may actually be leading up toward something good. It also comes with a constant reminder that collectors and investors have to buy low and sell high – without getting too greedy and thinking prices only rise.

The Glazers have not been without criticism for their effort and role in the short-lived Super League. The owners were being criticized over only caring about personal profits. The Glazers also are the “guardians” of the Tampa Bay Buccaneers and have been there for more than 15 years. Their purchase of the team reportedly created forced sales by thousands of fans without a choice.

As for the sale of the shares, the Premier League club is not going to receive any proceeds from the stock sale. What needs to be considered is that the Glazers have now demonstrated twice this year that they are willing to unload Manchester United shares. The latest pop was on “the return of Cristiano” followed by an 88% rise in broadcasting revenue to $347.3 for the trailing 12-months ended June 30, 2021. That time period is pre-Cristiano and the odds that the next 12-month period will be hampered by a COVID-19 pandemic like they have been over the last 12 -month period is (hopefully) very low. For the record, it is no secret at all that advertising revenues in general are quite strong at present.

A recently reported investment via Ariel Investments took its stake up to almost 14% from only 5%. That fund group now owns almost 6 million shares of Manchester United. While the Glazers are reportedly still quite committed to the soccer franchise, it is important to apply other historic moves where unpopular controlling shareholders dwindle their stake over time. It could ultimately be a good thing, even if this implies that there could be more drops following any future stock runs higher.

According to the press release and filings, the Kevin Glazer Irrevocable Exempt Family Trust and the Edward S. Glazer Irrevocable Exempt Trust’s offering is expected to close on October 8, 2021. The sole listed underwriter of the sale is BofA Securities, and BofA has proposed to offer shares of common stock — “from time to time for sale in one or more transactions on the NYSE, in the over-the-counter market, through negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices.”

The stock market is a discounting and forecasting tool that tries to price in news ahead of time. Needless to say, it doesn’t always work. The market obviously failed to consider that the Glazers would use stock strength for the second time in the same year to put some cash in the owners’ pockets. And now shareholders should at least know that if this stock gets anywhere close to $20 again that the Glazers may ring that register all over again.

It is very possible that the technical damage done by this secondary offering news will keep the shares weak for a while. There will be some upset share owners, but new holders will be looking at a chance to get in on a great team franchise’s stock. With a close at $16.94, the 200-day moving average of $16.57 more or less held Manchester United’s shares lows for the day. This was briefly under $15 over the summer, and some investors will be hoping that they get a chance to buy in closer to that level.

There is a lesson here — the stock market doesn’t give you what you want and it does not owe you a profit. That is easy to forget when the world is full of emotions and when everyone who risks money wants to be right and make a profit. Collectors often forget this message too. There is no such thing as a guaranteed profit in any asset class.

As for how this translates into the prices of Ronaldo’s top selling high-end soccer cards, the prices have been through the roof. A 2003 Christiano Ronaldo Mega Craques rookie card that was given a PSA 10 Gem Mint grade fetched $319,800 at a Goldin Auctions in early October 2021. This was not just an all-time high for a Ronaldo card. On August 11, 2021, a PSA 10 sold via Goldin Auctions for $156,000 and on May 24, 2021 a PSA 10 sold for $196,800 via Goldin Auctions.

(Image by StockCharts.com)