A stock split to stock market investors is generally considered to be one tool that corporations use as a reward to their investors. Unlike a dividend and unlike a share repurchase plan, the key difference in rewarding shareholders with a split is that it is merely a financial gimmick. No money changes hands. Shareholders simply have more shares at a lower adjusted price.

There is a whole history of stock splits over the most recent decades. Apple has split its stock 5 times and Microsoft has split its stock 9 times since they came public in the 1980s. Other great companies like Google (now Alphabet), Amazon and Tesla have all recently undergone stock splits to make shares “more affordable” for retail investors.

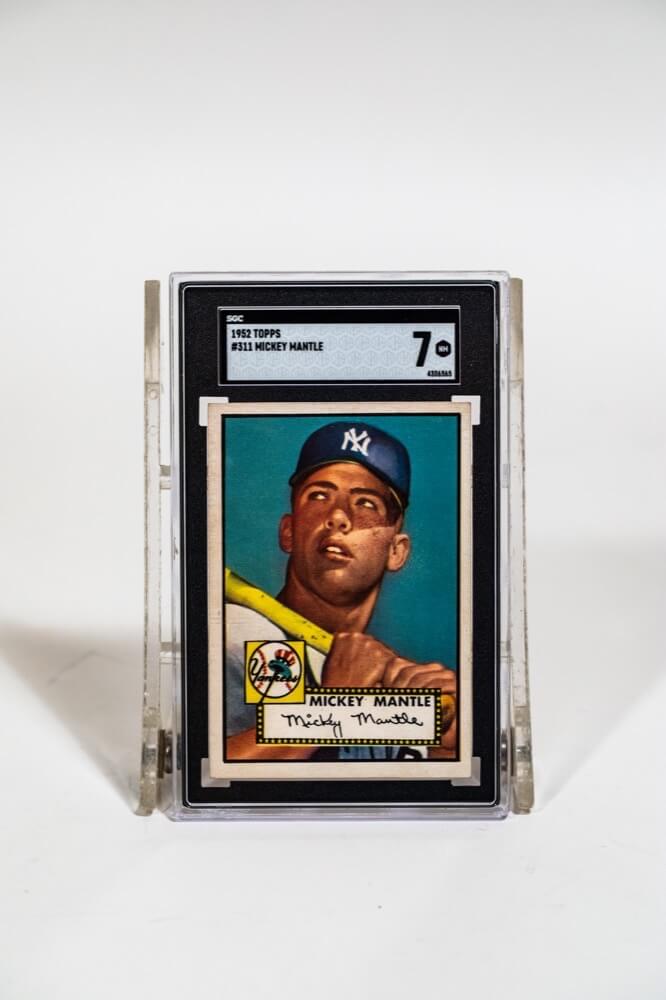

There is no way that an owner of a Mickey Mantle card can physically split the card up without destroying its value. At least that was the case until until fractional ownership and share offerings came to memorabilia and other high-end collectibles. Image below by RallyRd.

The fractional platform RallyRd. has announced the first ever stock split for the shares and price of an alternative asset on the Rally platform. An email was sent out to Rally Rd. customers with this communication:

The mission of Rally has always been based in democratization of the most important pieces of current and future history. Part of that mission means ensuring share prices are approachable for all budgets. In some cases, as asset values rise, share prices move further away from affordability for some investors.

With increasing access for investors in mind, and with the upcoming world record sale of an SGC 9.5 1952 Mickey Mantle card via auction, we’re announcing our first ever stock split – a 10:1 split of the SGC7 1952 Mickey Mantle Rookie Card.

Rally is also confirming that the split will not include any cash payments and will result in a higher number of shares for its holders. They confirm that this split “allows Rally to break each existing share into multiple new shares without affecting the total value of all shares or each investor’s stake in the underlying asset.”

This is, of course, a financial gimmick because the actual share price shouldn’t matter. The one benefit is that newer shareholders will be able to buy the shares at a cheaper price — and more buyers in theory drives up the price if there are more shares being bought than sold.

The downside is that existing shareholders of record will suddenly have more shares that allows them to sell and lock in profits — which would drive the price down if there are more shares being sold than bought.

As for why this split matters here in this specific case, the last nominal share price for the SGC graded 7 example of the 1952 Topps Mickey Mantle was $350.00 per share. The high bid at this time was $324.50 and the lowest ask was $375.00. At the last closing price of $292.50 per share, the implied market cap of this card was $292,500.00. Needless to say, a $350.00 share price last represented for the 1952 Topps Mantle generates and even higher market cap. The fractional ownership platform has enjoyed the benefits of “the $10 million Mantle card” that is up for grabs right now.

The great Warren Buffett believes that stock splits simply do not matter. That said, he had to ultimately split his shares into two classes. The Class-B shares were last seen trading at $296.00 per share, while the prized Class-A shares were last seen trading at $445,095.00. How many people can afford a single share that costs more than $400,00.00? Well, maybe stock splits do matter after all.

Sometimes gimmicks work. And sometimes they don’t. We will have to see how this first ever alt-asset split pans out. The reality is that if 1952 Topps Mickey Mantle prices keep posting their annual gains then this should work out fine. If the fractional ownership platforms do not attract more assets or if the prices of Mickey Mantle cards fall significantly, then the alt-asset price split won’t look so great.

DISCLAIMER: And for disclosure purposes — I am personally a RallyRd investor/client/customer and invest in public and private individual stocks.