It probably seems odd to pan a cryptocurrency right after challenging all-time highs all over again. The good news is that this isn’t a challenge to Bitcoin and the cryptocurrencies that are also riding the crypto-wave. Whether you are an investor, a collector or a speculator you have by now undoubtedly dabbled in cryptocurrencies whether you actually knew about it or not.

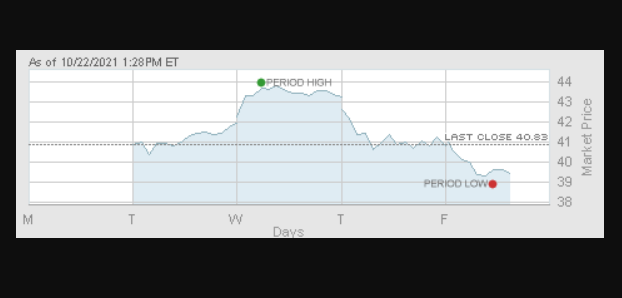

The week of October 22, 2021 was monumental in that the first Bitcoin related exchange-traded fund (ETF) was released. Investors cheered the arrival for obvious reasons, mainly in that investors and collectors have even more direct avenues to get crypto-exposure. And then the selling pressure came on strong.

Before you think this is a hit-job or a pan against cryptocurrencies, blockchain, digital assets, funds and ETFs that invest in them, this is not. What you are being given here is a brief explanation of the mechanics of the ETF, how others may work, and what some industry experts have to say about these. It is important to know that the SEC has so far only approved Bitcoin ETFs using futures.

The ProShares Bitcoin Strategy ETF (BITO) made its debut on Wednesday. Two rules need to be considered here before even considering the drop in cryptocurrencies. The first rule of investing in ETFs is to know that not all ETFs are actually classical ETFs like those that track the S&P 500 (SPY) or the NASDAQ 100 (QQQ). The second rule of investing ETFs is to understand the exact mechanics of what it is that you are buying.

There may be a perception of “The Bitcoin ETF will be a buyer of lots of Bitcoin!” That is not exactly the case.

The crypto market has been selling off on the BITO arrival. It may be coincidence or a bit of a “sell the news” reaction. Most importantly, the “BITO” arrival has some inherent issues that come with stark reminders for investors and collectors alike. It is an inconvenient fact that ETFs (and ETF-like products) that invest in futures rather than in the direct underlying assets come with some unique characteristics. ProShares itself has an upfront reminder about what its Bitcoin Strategy ETF does and does not invest in. The intro notes say:

- The Fund seeks to provide capital appreciation primarily through managed exposure to bitcoin futures contracts.

- The fund does not invest directly in bitcoin.

- The price and performance of bitcoin futures should be expected to differ from the current “spot” price of bitcoin.

As of the close of October 21, 2021, the “BITO” had an exposure value of $680,853,600.00 that was made up of CME Bitcoin futures and two series of Treasury Bills that mature in 2022. With the other net assets and cash the total market value was $1,209,443,893.70.

It is going to be a while before investors get to see how many shares are being sold short as a bet against Bitcoin. To be honest, those might not even be bets against the long-term prospects of Bitcoin. Some short sellers will have simply been short because they are making short-term market bets around upcoming roll dates. The Bitcoin Strategy ETF prospectus shows the exact risks and disclosures and this is where the guts of the matter are.

With Bitcoin having been down over $2,200 at $61,252 on Friday mid-day, that is down from Bitcoin’s peak of more than $66,500 on Wednesday. BITO’s opening price of $42.22 on Wednesday had a closing price of $43.28 with more than 29.8 million shares trading hands that day (total implied dollar volume of nearly $1.3 billion). That is much better than “not a bad debut” for an ETF launch, and time is going to tell whether trading volume goes up or goes down — and time will tell if “better ETFs” are there for Bitcoin tracking.

The overall market bias for Bitcoin is back to overwhelmingly “positive” with pundits issuing $100,000 Bitcoin price targets by year end and $500,000 (or higher) longer-term. Needless to say, parents can now much more easily gift Bitcoin to their kids and grandkids for birthdays and holiday presents. This is where the “collectibles” nature of Bitcoin is going to come into play.

Several prominent figures have opined about the arrival of the so-called Bitcoin ETF this week, but it is important to consider a few drivers that are taking place right now in the world of crypto. Institutions are starting to take on direct purchase exposure of Bitcoin. Family wealth advisors have finally warmed up to Bitcoin and other cryptocurrencies. And financial institutions and “fin-tech” providers like Square, PayPal, Silvergate, Coinbase, Robinhood and a whole slew of others have already been allowing for direct purchases and/or transactions to occur in Bitcoin and other cryptocurrencies.

There is always an interesting game that I like to play — What if every millionaire wants to own (fill in the asset)? This is the case of course for Bitcoin, but in the past this is a game you can play for all sorts of alternative assets you might never have considered assets before like guns and ammo, long-life food and water, gold and silver, and many other things that would skate the lines of collectibles or alternative assets.

So what if every millionaire decides they must own just 1 Bitcoin? What is a fair price then? No one can give you a definitive answer there, but the honest answer is “A Lot Higher!”

Let’s consider an estimate from Credit Suisse that counted the number of millionaires around the world as 56.1 million as of the end of 2020. Put that in context with the notion that there are a maximum of 21.0 million Bitcoins that can ever be minted. The official tally of Bitcoins that exist is just over 18.85 million Bitcoins and roughly 900 new Bitcoins being mined each day. There may be 2 million (or more) Bitcoins that have been lost due to hardware failure, lost or forgotten passwords and deaths.

Anyhow, if 56.1 million people who already have $1 million or more in liquid assets has to buy a coin, then the price calculation still has to be “Higher!” as noted earlier. With an ETF already launched and with more ETFs lurking to be launched imminently, there are also the bets that can take place that are short (Betting against) Bitcoin. And with the ETF holding futures rather than the full underlying Bitcoin (again, ProShares states that right up front) then these ETFs may experience some form of decay over time or tracking error. That would be very similar to what has happened with ETFs and similar products that owned energy futures (see below) rather than owning the actual commodities.

The United States Natural Gas Fund, LP (UNG) and United States Oil Fund, LP (USO) have seen roll dates in the futures contracts impact their performance. The “USO” saw multiple strategy changes in what it would and could own so that the tracking might become more similar to moves in the price of oil.

And the second Bitcoin ETF to launch was the the Valkyrie Bitcoin Strategy ETF (BTF) and its CEO did a Yahoo!Finance living room interview about its launch. Both the “BITO” and the “BTF” have expense ratios of 0.95%. In short, that means an investor will pay $9.50 in management fees each year for every $1,000.00 invested. That expense ratio is not “cheap” versus the most liquid equity ETFs but most Bitcoin and crypto investors and “HODLrs” simply aren’t go to avoid exposure because it may cost them 1% per year.

Grayscale already offers the Grayscale Bitcoin Trust (GBTC) and other crypto trusts that own alts like Ethereum, Litecoin, Bitcoin Cash and so on. And it has also applied for an ETF conversion. There are also a whole host of smaller companies that are listed in the U.S., Canada and Europe which have direct exposure to owning Bitcoin and alt-coins. Again, just understand what you are actually investing in before you jump into any real position blindly.

Let’s get back to the notion that several prominent figures have opined about the arrival of the so-called Bitcoin ETF this week.

Lindsey Bell, chief investment strategist for Ally Invest, has noted that “BITO” is another stamp of legitimacy for the (crypto) space. She even noted: Old Wall Street and new Wall Street are slowly coming together. She also warned investors, or reminded investors perhaps, to monitor BITO’s volumes. She said:

There’s such a thing as too much popularity in the futures ETF space, and that may already be happening if BITO is bumping up against CME position limits. In the past, funds have become unhinged from the markets they track when the trading volume has spiked too quickly. If BITO is forced to roll into longer-dated futures, it may lose some correlation to actual Bitcoin prices.

There is also the proposed ARK 21Shares Bitcoin Futures Strategy (ARKA) that is expected to arrive shortly. The fund’s adviser will be Alpha Architect and cryptocurrency asset manager 21Shares is listed as the sub-adviser. ARK’s Cathie Wood, one of the top fund managers in the country, has publicly forecast that Bitcoin will ultimately rally to $500,000. Her funds have invested in handily in shares of cryptocurrency exchange Coinbase and other companies which have exposure to cryptocurrencies and blockchain assets.

According to an October outlook report by Bank of America Securities (Merrill Lynch for you older peeps), digital assets are just in the first inning. And at the same time, the well respected Jamie Dimon of JPMorgan Chase (JPM) has been rather vocal against Bitcoin and cryptocurrencies.

You were told earlier that this was not an anti-crypto piece nor that it was a hit-job on Bitcoin and the alt-coins. For the record, I personally own direct exposure to Bitcoin, some alt-coins and other digital assets. I currently own indirect exposure to Bitcoin and crypto through PayPal (PYPL) shares (and on and off ownership in Silvergate Capital “SI”).

As Texas has been aiming to be a key leader in cryptocurrencies, the Houston Firefighters’ Relief and Retirement Fund (HFRRF) is among the first public pension funds to announce that it has taken direct exposure into digital assets like this. The press release included the note that the HFRRF has invested directly into Bitcoin and Ether in a partnership with NYDIG. Ajit Singh, HFRRF’s Chief Investment Officer, said of the moves:

We are excited to take this first step forward into the world of digital assets. This investment expresses our belief in the disruptive potential of distributed ledger technology for the development and democratization of value accumulation through disintermediation. We have been studying digital assets’ transformative potential for some time, and we are pleased to have a partner of NYDIG’s caliber to ensure secure, robust and efficient execution, and enhanced compliance as we enter this new market.

Categories: Digital& NFT