Digital collectibles were made fun of for much of 2021, but the reality is that billions of dollars worth of transactions have been seen on platforms. Digital collectibles are already off to a strong start in 2022. There is a fresh business merger that needs to be watched closely, and it’s huge — Microsoft Corporation (NASDAQ: MSFT) has announced the nearly $70 billion acquisition of Activision Blizzard, Inc. (NASDAQ: ATVI).

While this is mainly about owning an even larger piece of the video game industry, the reality is that this is going to be a huge deal for digital collectibles and the metaverse. It is also likely to speed up the adoption of more things tied to cryptocurrencies and all things virtual.

SIZE MATTERS (IT’s HUGE!)

The Activision Blizzard purchase price of $95.00 per share was nearly a 50% premium versus its recent stock price close, but what should stand out here even more is that this is an all-cash transaction that is valued at $68.7 billion.

Some collectors may wonder why this matters for collectibles. It’s not that this is just about graded video game sales, although this will probably even have a continued spill-over benefit for the graded games by WATA and the like. The implications are for what this can do to accelerate the adoption of the metaverse — which of course is going to make many more digital items beyond Bitcoin, Ethereum and other cryptocurrencies and digital assets.

Microsoft announced the acquisition of Activision Blizzard will accelerate the growth in its gaming business across mobile, PC, console and cloud. But where this matters for future collectibles is that the deal also “will provide building blocks for the metaverse.”

Microsoft did say this deal will position it as third-largest gaming company in the world by revenue, behind only Tencent and Sony. On top of bolstering Microsoft’s Game Pass portfolio by launching Activision Blizzard games into the more than 25 million member Game Pass community, most of the press release continues to be about the cloud and mobile gaming as well as desktop and systems.

METAVERSE, DIGITAL, CRYPTO, NFTs

It is important to understand the ramifications of this acquisition in the metaverse. If Microsoft is going out and spending nearly $70 billion in cash, you can bet your assets (and what you are sitting on) that CEO Satya Nadella knows he is on to something here.

Collectors now include non-fungible tokens (NFTs) with millions of dollars being transacted on most days now. These are transacted in Ethereum, Bitcoin and others.

Before this sounds fishy here, let’s do a deeper dive. Microsoft will now become a key entry point for millions of users to access the metaverse (or metaverses). It owns LinkedIn – so virtual interviews will take place in the metaverse rather than just on Teams, Skype or Zoom meetings. Marrying the 25+ million Game Pass subscribers with the Activision Blizzard universe of nearly 400 million monthly active players (in 190 countries) will be huge. It may even collide work/private/social platforms all at once.

DOWNSTREAM IN THE METAVERSE & ALL THINGS D

Let’s think about some other corporate deals that involve the metaverse. This only scratches the surface, but these are some of the real-world issues happening right now in the space.

Facebook’s Mark Zuckerberg just recently went all in with a formal name change to Meta Platforms, Inc. (NASDAQ: FB) as its commitment to the metaverse. Sure, this was also perhaps an effort to get the focus of only being about Washington, D.C. and regulatory scandals. Still, it is a huge commitment. What ever happened to that Facebook stablecoin?

NIKE, Inc. (NYSE: NKE) announced the acquisition of RTFKT in December 2021. RTFKT is a top brand that delivers next generation collectibles that merge culture and gaming. In short, the creators of virtual sneakers, collectibles and experiences in the metaverse can immediately be extended to every single item that NIKE sells physically. They are using game engines, NFTs, blockchain authentication and even augmented reality to create unique virtual products and experiences.

There is also fresh news that Walmart Inc. (NYSE: WMT), the world’s largest brick-and-mortar retailer, has filed with the U.S. Patent and Trademark Office in what appears to be its own cryptocurrency and non-fungible tokens. This will of course expand the metaverse – virtual showrooms and changing rooms anyone?

GameStop Corporation (NYSE: GME) recently (and finally) announced its plans to launch a business unit dedicated to NFTs and cryptocurrency. It will have its own partnerships and will of course have its place in the metaverse. GameStop is the largest (and perhaps last-man standing) standalone video game store operator which has been dedicated 100% to video games. It has also expanded collectibles sales, which will now include more digital offerings.

Companies like NVIDIA Corporation (NASDAQ: NVDA) and Advanced Micro Devices Inc. (NASDAQ: AMD) are making large strides to sell processors that will help users with the virtual experiences (oh, and digital mining and efforts). You can bet that Intel Corporation (NASDAQ: INTC) wants its piece of the next growth market and Qualcomm Inc. (NASDAQ: QCOM) will want to maintain its dominance in mobile — all of which tie in to the metaverse.

AS FOR WHAT MICROSOFT IS THINKING…

Sometimes you need to look at what is hinted at in press releases other than just the main points. Of course this is about a digital takeover of one of the greatest gaming companies. So what did the company say that makes Collectors Dashboard believe this has big ramifications for the metaverse (and therefor digital collectibles)?

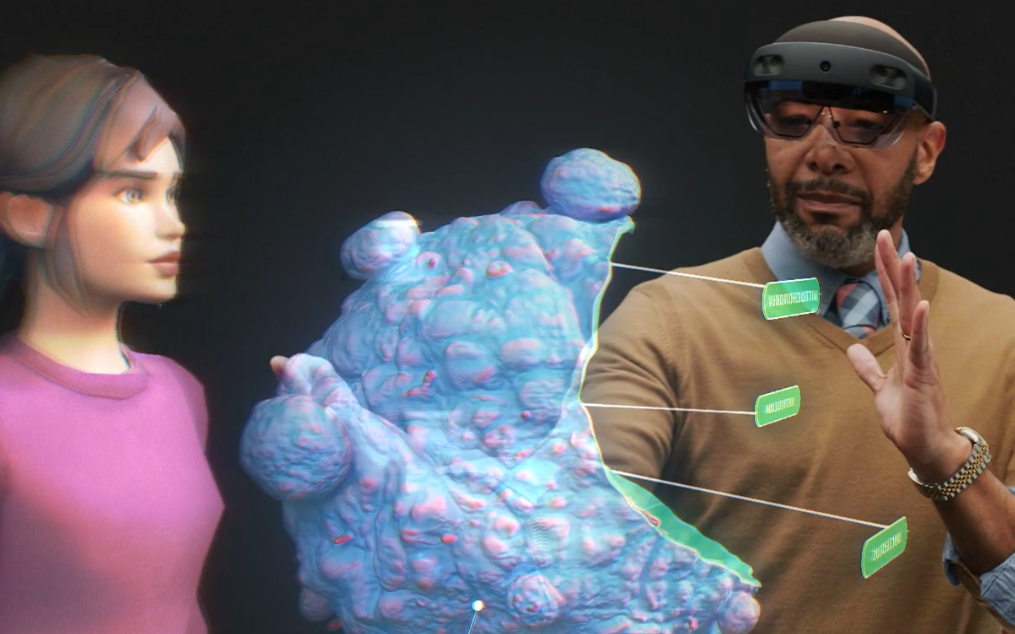

Microsoft is making a product called HoloLens, under development as Project Baraboo (Image below at Microsoft. This is a pair of mixed reality (virtual/augmented) smartglasses. It was the first head-mounted display running the Windows Mixed Reality platform under Windows 10 as well. These are going to play a serious role in the adoption of that and/or other very similar headsets. Does anyone remember that Facebook acquired Oculus for $2 billion?

Satya Nadella, Microsoft’s chairman and CEO, said:

Gaming is the most dynamic and exciting category in entertainment across all platforms today and will play a key role in the development of metaverse platforms. We’re investing deeply in world-class content, community and the cloud to usher in a new era of gaming that puts players and creators first and makes gaming safe, inclusive and accessible to all.

Satya didn’t go out and tell you it’s time to buy NFTs blindly and he didn’t just tell you which pieces of virtual real estate you should be acquiring. What he did tell you is that the metaverse is coming, and this video game acquisition only going to more rapidly expand the digitization (or digitalization) of the collectibles industry.

Categories: Digital& NFT, Misc., Technology