It is now undeniable that the collectibles sector has matured into an alternative asset class. The reality is that certain collectibles have always been an alternative asset class for centuries. We do not know of instances of baseball cards being used for life’s necessities. What is not a secret is that fine art, fine jewelry and watches, gold and silver, diamonds and gemstones and other collectibles have been used over time for a variety of instances rather than money. And this isn’t even for collateral against loans — some of these items have been used for safe passage and “gifts” to escape conflict.

The year 2021 and the start of 2022 will probably become known as the reflationary years where higher prices became the norm. Whether the price gains will continue or stabilize longer-term remains to be seen. As it stands right at this moment in time, there is an armed conflict brewing whereby Russia appears poised and ready (and seems already determined) to send troops into Ukraine for an armed conflict.

It may seem insensitive on the surface to consider about asset prices and alternative assets during periods of war, hardship and other catastrophic events. If war occurs, lives will be lost. For those who survive, there can also be a great financial and societal cost. Collectors Dashboard evaluates high-end collectibles as an alternative asset class, implying that collectibles are attracting the same capital that could have been invested into stocks or bonds. Stocks and bonds have already seen an impact from the likelihood of armed conflict in Ukraine. Commodity prices have also risen handily — gold and silver, oil, natural gas, and so on.

The U.S. Bureau of Labor Statistics reported in January that consumer prices (the all-items index, or CPI) increased 7.0% versus December of 2020. This was the highest reading in about 40 years. The results of higher prices due to armed conflict at a period when inflation is already prevalent can have a significant impact on many aspects of our daily lives. And, yes, that may mean collectibles too.

At a time when inflation is already high, the growing risk of an invasion by Russia into Ukraine could juice prices even higher. All of these commodities play directly into may subcategories of collectibles in some form or fashion. The costs of transporting goods and keeping the electricity going are directly impacted by energy prices. The price of jewelry, watches, commemorative coins and so on are directly impacted by higher gold and silver prices.

GOLD & SILVER PRICES

Prior to January, gold and silver prices had not exactly been acting like true inflation hedges that some of the gold bugs and silver buyers may have assumed. So what happens when so many commodity prices which are intertwined with global markets economies could rise further and even substantially? We had already been tracking higher luxury watch prices at the start of 2022, even before the conflict news looked imminent and before metals prices shot up.

Over the last two years, gold’s high was above $2,000 per ounce (August 2020). Gold basically ended 2020 at $1800 per ounce when rounded to the closest number and closed out 2021 at basically $1,830 per ounce. That’s less than a 2% gain with consumer inflation at 7% year-over-year.

Gold was a bad inflation hedge in 2021. But with the risks of armed conflict higher, zoom forward to the present and gold was nearly $1,900 per ounce.

BITCOIN & DIGITAL ASSETS

What about Bitcoin? Many of the crypto-bulls have touted that Bitcoin and other cryptocurrencies or digital assets are great tools as hedges for uncertainty and inflation. The notion that the United States is now $30 trillion in debt is also brought up continuously by the crypto-bulls. Bitcoin peaked at about $69,000 in November of 2021 after having briefly been under $30,000 earlier in the year. The price of Bitcoin briefly dipped under $35,000 in January of 2022, but despite a recent recovery to above $44,000 in recent days the uncertainty and market trading has taken Bitcoin to just under the $40,000 mark on last look. Bitcoin is not acting as a hedge against inflation nor against uncertainty from armed conflict. Even if Bitcoin may be the “digital gold of the future” it is simply acting as a “risk-on” asset just like growth stocks at the present moment.

The ProShares Bitcoin Strategy ETF (NYSEArca: BITO) fell 2.1% to $25.11 on Friday, down from almost $28.00 earlier this week. The ETF owns Bitcoin futures rather than actual Bitcoin, but it has not had the tracking error that was widely feared at its onset. Coinbase Global, Inc. (NASDAQ: COIN) also fell 1.4% to $189.16 on Friday after its stock price briefly hit $213.00 earlier in the week. This is the largest public stock tied to crypto trading. Even Robinhood Markets, Inc. (NASDAQ: HOOD) saw its shares down 3.6% to $11.81 on Friday with its exposure to cryptocurrency and to growth stock trading. Robinhood is now down about 85% from its absolute post-IPO peak in 2021 and its market cap as of Friday’s close was under $9.9 billion.

The last week has also seen continued strong news around non-fungible tokens (NFTs). The NonFungible.com website has shown that the Bored Ape Yacht Club (BAYC) led the last week of sales with 567 transactions valued at more than $52.4 million. The site showed that CryptoPunks NFTs saw 62 transactions valued at more than $38.7 million in the last week. And we cannot overlook that Topps (image below) is still soon to start bids for the official release of the Mickey Mantle 1952 Baseball Card NFT.

Collectors Dashboard has already outlined how gold and silver would become more of a focus than crypto around the current situation in Ukraine and Russia.

STOCKS PRICES AROUND CONFLICT

What about stocks and bonds? The price of stocks needs to be broken down into groups. There are utilities and defensive stocks like consumer products and food which are of course part of life’s necessities. They have held up better around the thought of armed conflict, and energy stocks like Exxon Mobil (NYSE: XOM) and Chevron Corporation (NYSE: CVX) have seen their stocks rise about 50% over the last year as oil prices have continued to rise. The high-growth technology sector and companies that are still effectively business plans with no clear path to net profitability are paying a significant price as their prices have generally plunged since the start of 2022.

Certain stocks tied to gambling and pure disposable income have suffered in 2022. Armed conflict and inflation do not help, but the reality is that investors just are not currently going to reward companies that are going to not be profitable right now. It is part of the uncertainty aspects right now. DraftKings Inc. (NASDAQ: DKNG) was the posterchild of the bad boy stocks this last week after its path to profitability (actually positive adjusted EBITDA) was pushed out to Q4-2023. DraftKings shares fell 21.6% to $17.29 on 4-times normal trading volume Friday alone. This was a 52-week low and DraftKings is down nearly 80% from its peak, effectively “round-tripping” the stock price back down to its SPAC transition. Go ahead and try to argue that sports gambling money doesn’t compete against some aspects within sports collectibles spending. Most stocks tied to gambling were down on Friday and from attempted recovery prices earlier in the week.

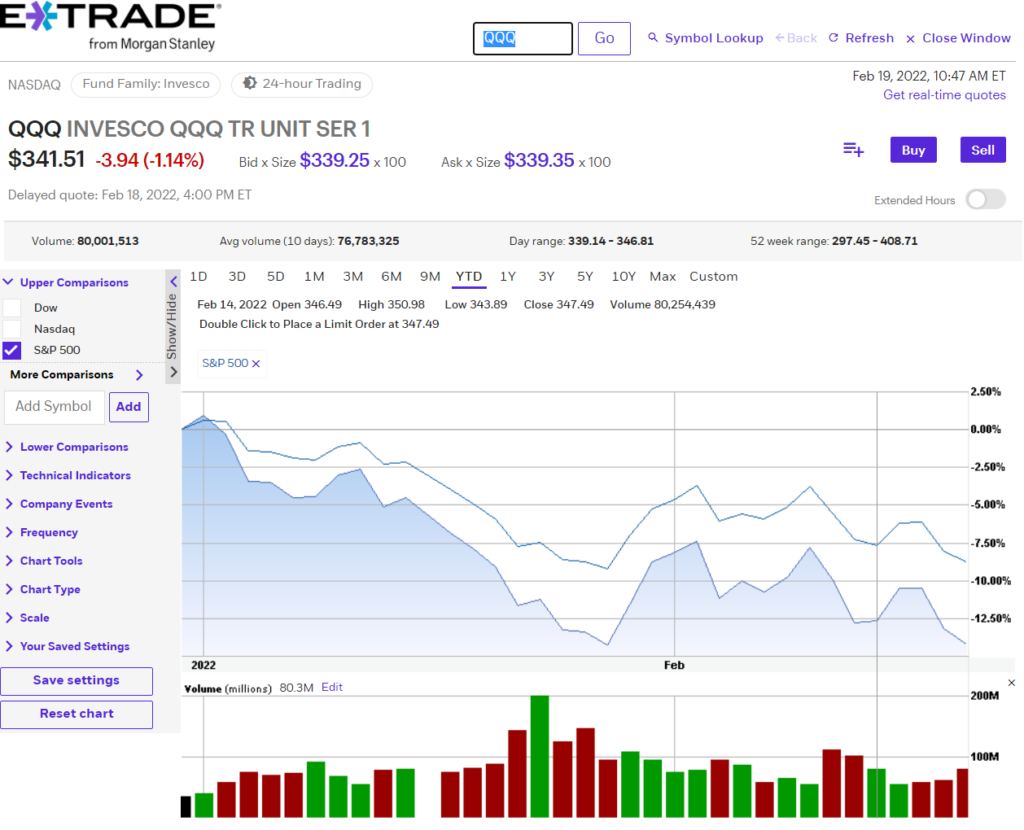

Meta Platforms, Inc. (NASDAQ: FB) is the company most of us still want to call Facebook. Founder Mark Zuckerberg may have changed the name and direction of the company during the peak of regulatory and political uncertainty in 2021, but the reality is that the stock performance of Meta Platforms has been atrocious and it is likely a huge signal that the metaverse rollout is going to take far longer than the rapid pace that was expected even late in 2021. Meta shares closed down 0.7% at $206.16 on Friday and that is down over 45% from peak stock price in 2021. All the Facebook content moderators may now be negative in their stock options there as well. The poor earnings reaction from Roblox also helps to signal a slower metaverse roll-out. The E*TRADE chart below will show how the tech-heavy NASDAQ-100 (QQQ) is doing versus the S&P 500 year-to-date.

BONDS AROUND CONFLICT

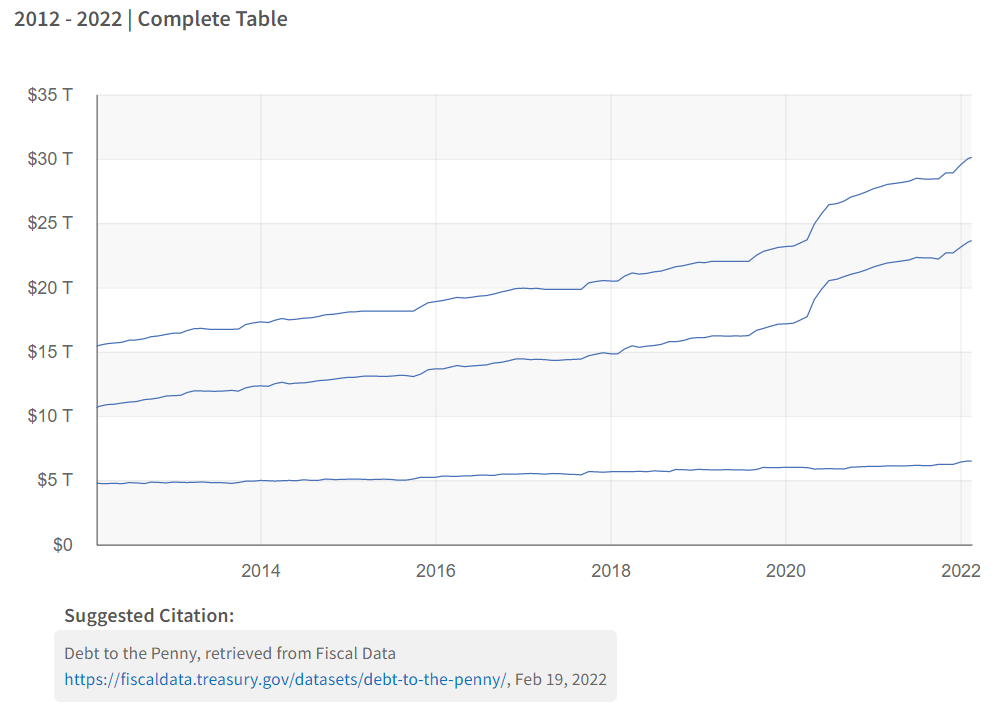

As for bonds, the prices are directly inverse against yields (interest rates). As prices go up, yields fall. If bond prices fall, then the yields rise. It’s that simple. The yield on the 10-year Treasury is the series that is most directly compared to long-term stock dividends, and it is the yield that most directly impacts mortgage rates. The U.S. now has $30.1 trillion in combined total debt outstanding (Treasury image below over last decade).

The 10-year Treasury yield was as low as about 1.15% last summer, and it closed out at 1.51% at the end of 2021 as the inflation news and determination by the Federal Reserve to raise interest rates in 2022 became more clear. And the 10-year Treasury yields recently went over 2.05% based on fear of continuous rate hikes — only to fall back to 1.93% on Friday as the “flight to safety trade” brought investors into the low-risk U.S. Treasury bond market again over fears of international conflict.

According to the U.S. Federal Reserve and U.S. Treasury Department data, foreign countries held a total of $7.55 trillion U.S. dollars in U.S. Treasury securities as of September 2021. These are the nations that own the most U.S. Treasury debt on last look. Japan was #1 at nearly $1.3 trillion, and China was #2 at nearly $1.05 trillion (and Taiwan is #10 at about $240 billion and Hong Kong was #11 at about $230 billion). The United Kingdom is #3 on the list at $566 billion, followed in order (rounded): Luxembourg $312 billion; Ireland $309 billion; and Switzerland $296 billion.

GENERAL COLLECTIBLES

It may not seem worth speculating about what will happen with the price of baseball cards, comic books, trophy coins and historical currencies at this point around armed conflict nearly half-way around the globe. These assets may be impossible to hedge against any price drops. The reality is that it seems hard to imagine the prices of those assets rising due to conflict, but in fairness the activity around eBay Inc. (NASDAQ: EBAY) and the large auction houses has remained quite strong as collectors and investors have not flinched yet — although the sports card investors collectively got their Super Bowl bets wrong in the one-sided winning QB trades!

Uncertainty is rarely good for risk-on asset prices. So far we just are not seeing a significant impact to the downside in the price of collectibles. That is of course not to be a universal statement or expectation, but the items tied to luxury, scarcity and vintage have performed well and met strong auction demand in 2022. That is still over a time when many of the younger modern athletes who are still playing have seen great weakness from the Q1-2021 peak prices.

And if gasoline and utility bill prices rise at the same time that food prices are rising, it’s hard to imagine as much being spent on all those new packs being released this week. Then again, the thought of pulling a Wander Franco card may trump any concerns and keep demand strong.

Categories: Coins & Money, Digital& NFT, Fine Art, Non-Sports, Sports, Watches & Jewelry