The crash of cryptocurrency, Bitcoin and most digital assets has been monumental. Let’s not forget that the scandals and implosions have been more than monumental after many investors trusted the wrong person. But if interest rates are really going to start seeing that tapering in the pace of hikes, is it time to reconsider gold and silver?

Many investors never gave up on gold and silver to begin with. These just not prove to be the hedge against uncertainty and rising rates that some investors hoped for. Neither did Bitcoin and the myriad of alt-coins that cratered in value over the last 13 months.

As gold and silver ETS like the SPDR Gold Shares (NYSEARCA:GLD) and the iShares Silver Trust (NYSEARCA:SLV) are taxed as collectibles. These are the two largest exchange traded funds of their kind. And many collectors have relied on gold and silver as alternative assets for decades 9or centuries). So here are these charts over the last year for gold and silver from StockCharts.com to review.

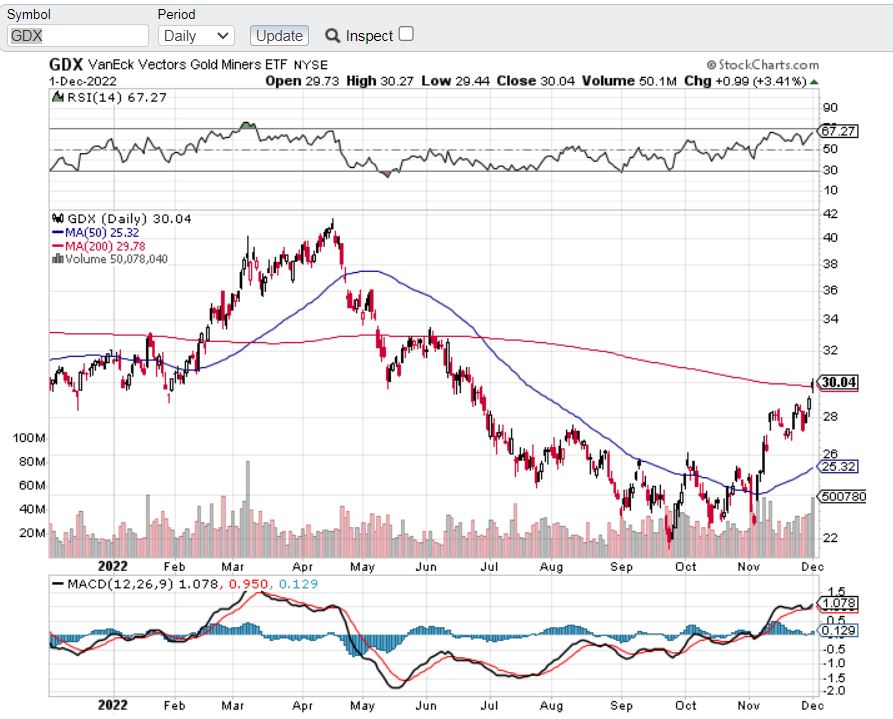

Do not forget to pay close attention to the 50-day and 200-day moving average. It turns out that the latest mega-crypto implosion has been quite good for gold and silver both. It’s been good for the miners and the Van Eck Gold Miners ETF (NYSEARCA: GDX) as well.

Categories: Uncategorized