Batman is at the tip of many collectors’ tongues right now. Many collectors want to see the movie that is released on March 4th titled: The Batman without question. This comes at a time that many “collectible investors” are also exploring opportunities around upcoming movie release dates. Batman is absolutely among the favorite comic book characters for collectors — but now there is a case being made solely as an investment.

Collectors Dashboard evaluates high-end collectibles as an alternative asset class. This means collectibles are attracting the same capital that could have been invested into stocks or bonds. Comic books with a price above $1 million would definitely fit within the theme of collectibles as an asset class. Just do not for a second think that this has a guaranteed profit coming with it.

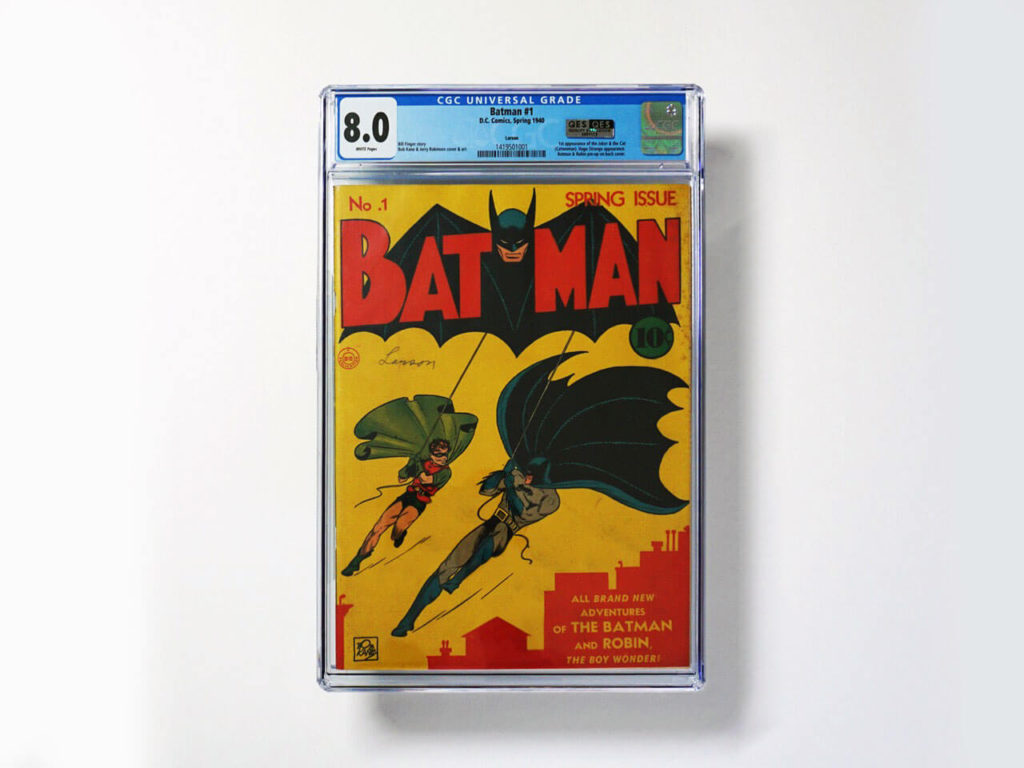

Goldin Auctions recently sold what appears to be the second highest recorded sale price of Batman #1 ahead of the upcoming movie release. February 18, 2022 was the second highest known sale of Batman #1 from Goldin Auctions to Rally Rd. for $1.8 million. The 1940 DC Comic Batman #1 is graded CGC 8.0 and welcomes a surge of attention for its March 4th movie release date.

Rally has reportedly chosen Batman #1 over any issue featuring The Riddler for the best possible investment return. That of course comes with no guarantees at all. The Riddler or his first appearance in Detective Comics #140 has not performed at auction the way Batman #1 has. The highest known recorded sale of Batman #1 was by Heritage Auctions for $2,220,000 on January 14, 2021.

Where the direct investment case comes into play is that Rally Rd. is a platform for buying and selling equity shares in collectible assets. In short, it is the fractional ownership model. This specific example of Batman #1 will be available to purchase for $10.00 a share on March 11, 2022 with a $2,000,000 market cap via the Rally Rd. app and its nearly 400,000 users of the platform. Image below by Rally Rd.

How fast Batman #1 will sell out on Rall Rd is the newest question for collectibles investors. There is already a lot of buzz about it on social media, but it is also being made available after the movie release rather than ahead of the movie release.

Rally Rd. issued a timeline for those who are considering its IPO. This is the part about the investment angle that they included:

- Sep. 2019 — A Batman #1 comic book graded CGC 8.0 is sold for $498K by ComicConnect.

- Apr. 2021 — Crossing the $1M mark for the first time, ComicConnect sells a copy of Batman #1 graded CGC 8.0 for $1.2M.

- Sep. 2021 — Goldin Auctions sells a CGC 8.0 copy of Batman #1 for $1.44M.

- Feb. 2022 — Rally enters into an agreement to acquire #BATMAN and offer it on the Rally platform.

A new class of investor is getting into the Batman spirit in the same way true fans of the comic did. True fans of the comic and investors alike know that this movie release has the potential most closely aligned with a Batman actor reboot in the form of Batman and The Riddler.

It seems hard to fathom after all of the modern movies and with millions of varying new Batman comic books sold that Batman almost died a tragic death in the 1960s due to poor comic book sales. Suddenly, with a new editor and also a new designer for the DC hero, Batman’s character may have become immortal after the 1966 Batman TV show with Adam West creating a surge in comic book sales.

Collectors Dashboard looks forward to following along as the next step for comic investing develops alongside record sales and iconic movie franchises — but we need to make a serious reminder about “investing” and “collecting” that no one should ever disregard:

A common disclaimer phrase is “investing in stocks involves risks, may result in losses and past performance doesn’t guarantee future returns.” If that has to be said about the S&P 500 or any stock, it has to be said much louder in collectibles. There are zero guarantees for a profit when buying comics, trading cards, coins, stamps and so on. In fact, anyone buying collectibles has to know that the market (versus stocks and bonds) is much less efficient, comes with much higher transactional costs, and it has the equivalent of much wider bid/ask spreads!

Now you have heard the investing case behind this Batman comic from the Rally Rd. aspect. They are not making any assurances that this is a sure bet. As for the upcoming movie’s ending, we will at least say it’s a safe bet that Batman will survive at the end to make future appearances.

Categories: Comic Books, Misc., Movies