There are many reasons that gold buys just love owning gold. These reasons can vary greatly even if the end results is “….and that’s why you want to own gold!” Some are ultimate safety, political unrest, inflation, devaluation of currencies, industry, jewelry and simply as an investment allocation. But in 2022 we have inflation that half of the United States population has never even seen or heard of. And interest rates are set to rise handily beyond the recent “first of many” Federal Reserve interest rate hikes.

There are many reasons for gold investors to be afraid in 2022. The Russian invasion of Ukraine is only one threat. Perhaps that biggest threat is for the first time in years gold will finally have competition from interest rates and saving/deposit accounts.

Should you even buy gold in a rising interest rate environment? The answer, particularly if you have no gold exposure at all, would be — probably so! And that leaves the “When” in this equation.

First and foremost for a disclaimer — Collectors Dashboard is not recommending for any person or institution to run out and buy gold blindly. That would be a foolish or a reckless move. We also only view any of these as “allocations” for those who can actually diversify. And, candidly, we would love to just interject the term “Bitcoin” into any place the word “gold” appears but there just is not a history yet that can back that up. So, at least for now, let’s just keep this view relating to gold.

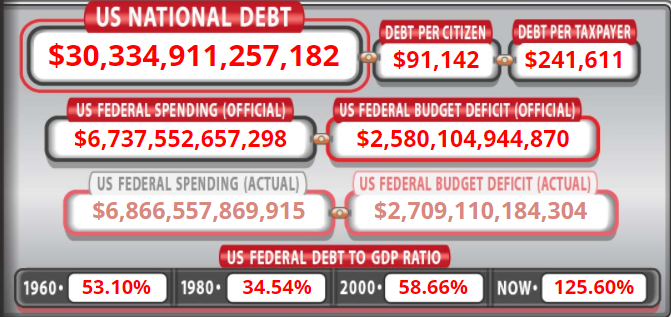

On top of an expected six more or (or so) rate hikes over the course of 2022, the Federal Reserve’s balance sheet has come near the $9 trillion level (and the U.S. Debt Clock is now over $30 trillion).

The World Gold Council’s outlook for gold in 2022 had some insights into where gold prices might be heading. Gold closed out 2021 approximately 4% lower than 2020 at $1,806 per ounce. One key driver was gold ETF outflows. At the start of the fourth quarter in 2021, the Council observed that ETF outflows had the gold demand down 7% year over year and down 13% from the second-quarter alone.

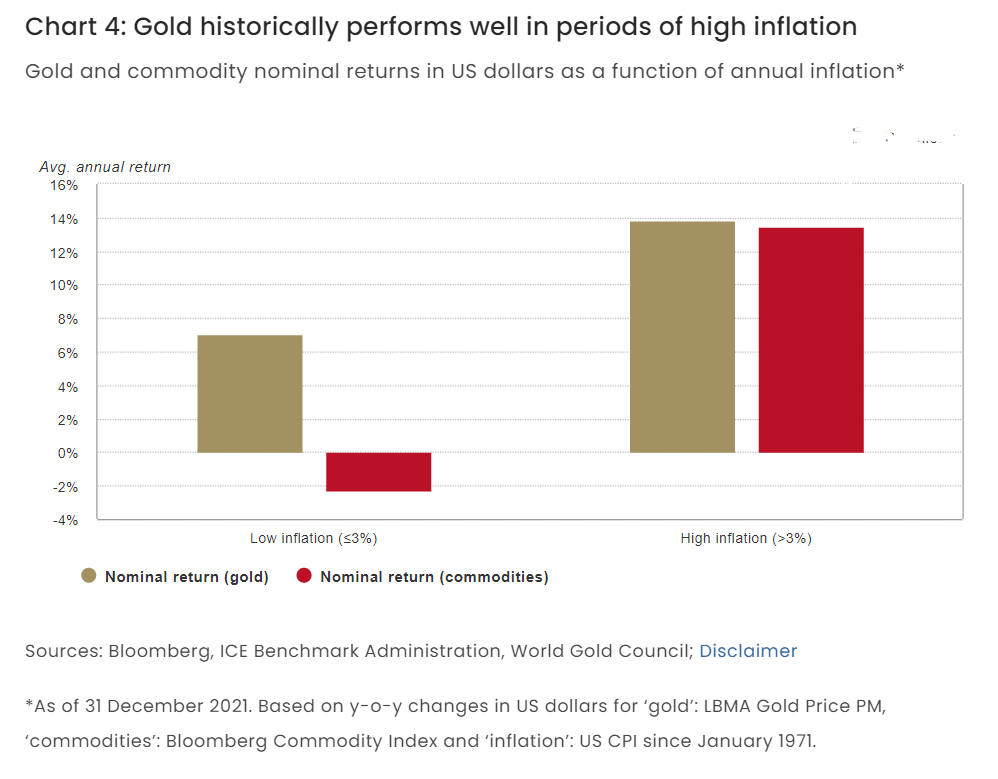

One unfortunate reality is that gold frequently fails to act as a true inflation hedge. Even then, the World Gold Council has maintained that elevated inflation and market pullbacks are both likely to sustain demand for gold as a hedge. And the World Gold Council’s chart below shows the relationship of high inflation versus gold.

The Council also warned that “competing forces support and curtail its (gold’s) performance” and that the speed central banks tighten are key. The good news for gold bugs is that the World Gold Council has stated the effect of rate hikes may be limited.

The Gold Council does offer a historical perspective on rising interest rates and the behavior of gold prices. They have been operating since 1987, and some of the original had already experienced the market moves of the 1960s and 1970s. Also worth noting is that interest rates were much higher in the 1980s than in the modern era. Here is how the Council sees the pulling effect of interest rates:

Gold has historically underperformed in the months leading up to a Fed tightening cycle, which would be a “now” timeframe. They have noted that the price of gold has significantly outperform in the months following the first rate hike. Conversely, U.S. equities have tended to enjoy their strongest performance ahead of a tightening cycle but delivered softer returns thereafter.

Whether or or not you would choose the statement of “the months following the first rate hike” as now is up to you. It seems that if there are going to be another six or more rate hikes that maybe that means “after a couple more hikes” rather than at the end, but that is all up to you. And we just have to keep in mind that the global financial markets have many moving parts that drive, supply, demand and prices of commodities. That means that gold could move up or down wildly for not even any of the reasons that have been cited here.

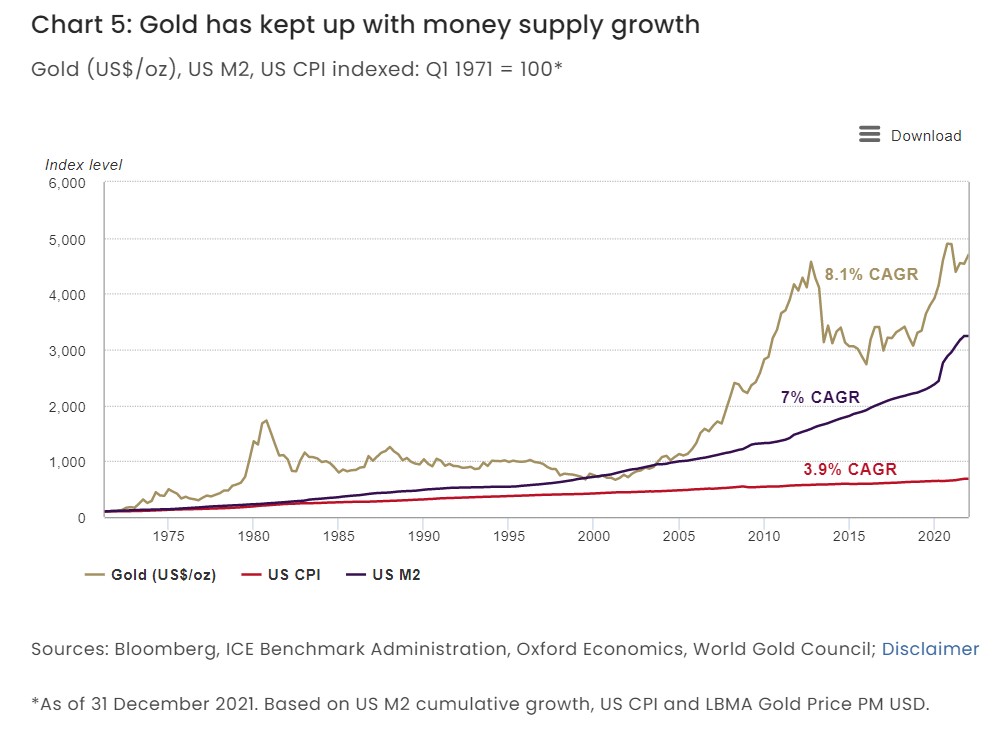

There is another caveat that should be considered with gold and inflation, and that is the M1 and M2 money supply. The Federal Reserve released its M1 base deposits as $20.694 trillion for February 2022, up from $18.368 trillion in February 2021. That is a 12.6% increase in the base cash/deposit accounts of the U.S. economy in just a year without even getting creative on other asset values that could be converted to cash. Maybe that 7% inflation reading really was backed up by all the cash that was thrown into the system in 2021.

As always, you are expected to do your own research and form your own opinions to draw your own conclusions.

Categories: Coins & Money