There is Bitcoin, and then there is everything else in cryptocurrency or digital assets. One of the backdoor plays into Bitcoin, crypto and digital assets is Silvergate Capital Corporation (NYSE: SI). In short, this is the financial institution powering all of the companies making stride in this space.

Silvergate more than doubled its earnings to $27.4 million in the first quarter of 2022, led by growth to more than 1,500 digital customers from less than 1,400 at the end of 2021. Its customer deposits of digital assets also rose to $14.7 billion from $13.3 billion at the end of 2021, which is impressive considering that the price of Bitcoin and many cryptos traded lower over the course of the first quarter.

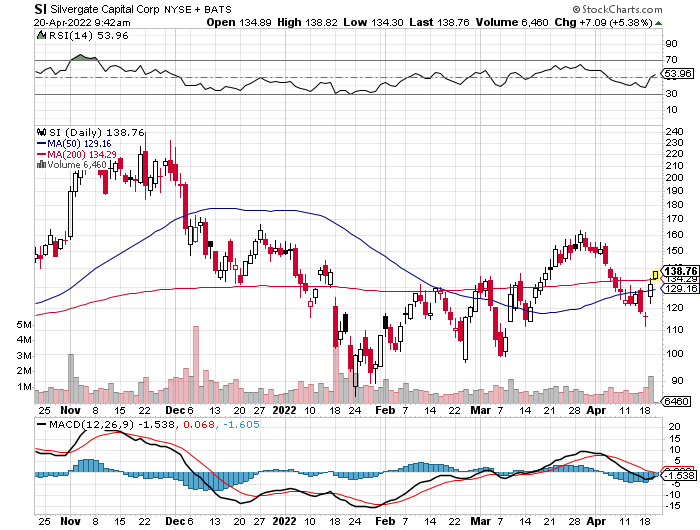

Ahead of earnings we had already seen BofA’s Brandon Berman initiate coverage on Silvergate with a Buy rating and a $200.00 stock price target. That would have represented 45.6% upside from the then-recent $137.30 closing price in March. Well, Silvergate had closed down at $116.31 ahead of earnings and the post-earnings reaction took shares back up 13% to $131.67. Even with the post-earnings bump, Silvergate shares are down 11.1% year-to-date.

On the heels of the earnings announcement the brokerage firm Canaccord Genuity has reiterated its Buy rating. The firm also raised is target to the $200 from a prior $164 price target. The firm’s David Chiaverini believes that deploying excess liquidity and guiding expenses lower should be a combination to dive Silvergate’s earnings higher. If Chiaverini’s $200 price target is achieved, that would represent almost 52% in implied upside from the post-earnings closing price.

DISCLAIMER FOR OUR READERS: As a reminder to crypto investors and traditional investors alike, analyst price targets are generally based upon the same information that is available to the public. Every investor in any asset class, traditional and alternative assets alike, should do their own research to form their own conclusions. It is very frequent that two analysts will have close to the same views or observations on the current position of a company, but one will conclude “therefore, our clients should be buyers” while the other suggests for their clients to sell or avoid it.

Chiaverini did cite that Silvergate’s strong quarter was despite lower Bitcoin and Ethereum trading volumes (which also drove SEN transfer volume and period-end deposits lower sequentially). Silvergate’s net interest income came in well above their forecast even as loan growth was lower than expected (related to a sale of real estate loans in portfolio that had been in run-off mode).

Silvergate has the Silvergate Exchange Network (SEN) that continued to see strong growth in commitments. Canaccord’s report continues to point toward the launch a U.S. Dollar-backed stablecoin. It said:

The company’s previously announced plans to issue a US dollar-backed stablecoin remains on track to launch at some point in 2022. The initiative will launch with a small pilot program, which will likely result in very little related deposit inflows this year. Silvergate has maintained ongoing dialogue with ex-Diem association members and is encouraged by conversations related to stablecoins with existing “cyrpto-native” clients (i.e. gaming, social impact companies). While not confirmed, Silvergate could launch its stablecoin initiative with an existing customer who has a strong understanding of the digital asset space. The company also reiterated that it is open to white-labeling its stablecoin, allowing users to brand it as they see fit within their own respective ecospheres, which we believe could accelerate adoption.

We reiterate our Outperform rating given Silvergate is the most asset sensitive bank in our coverage, has a favorable growth outlook given a significant amount crypto hedge fund capital formation and capital inflows into the space, expenses remain well-managed with significant operating leverage in the business model, there’s significant potential stemming from the rapidly expanding digital currency market, and the incremental benefit from its stablecoin initiative.

And to show both sides of the coin, Silvergate’s Buy rating was maintained as Goldman Sachs while the firm did trim its prior $210 price target down to $180. BofA Securities also maintained its Buy rating and kept its $200 price objective, noting that the firm is awaiting the outlook on Silvergate’s stablecoin efforts.

Below is a stock chart measuring the last 6-month period from StockCharts.com.

Categories: Digital& NFT