Let’s face it — stock market crashes are not fun for the general public. The public just isn’t really able to be aggressive short sellers (betting that price will go down) ahead of the rare days that the Dow Jones Industrial Average is down over 1,000 in a single trading session. If the value of stocks is plummeting, then the value of everything else like collectibles has to fall too! Or does it?

Collectors Dashboard evaluates high-end collectibles as an alternative asset class. This means collectibles are attracting the same capital that could have been invested into stocks or bonds. This begs the question about what happens to collectibles and high-end collectibles during periods of a stock market crash. This is particularly important now that collectibles routinely have investors competing against collectors for the exact same assets.

Stock market crashes are not all that uncommon in the modern era. The stock market and other financial markets try to factor in all events, for better and worse, months into the future. The reality is that financial markets are very poor at pricing most events in. The so-called “Efficient Market Hypothesis” just is not that efficient.

Your definition of a stock market crash may be different than others. A stock market crash should really just be considered a rapid drop in stock prices. These crashes can be short-lived, or they can be a prelude to a bear market where asset prices trade down for a prolonged period of time. These stock market crashes are very painful when they are happening, but they also present amazing opportunities for those who have the courage and ability to step in and buy while prices are low.

So again, what happens to things like fine watches, baseball cards, fine art, and even fine wine during a market crash? If the value of all assets have to be related, then collectibles have to pay a price just like stocks. That seems like good logic, but it just isn’t always the case.

A stock market crash should be bad for collectibles if it is the start of hard economic times ahead. Expecting a LeBron James card to rise during a recession might not be realistic. Then again, if it is a short blip in time these crashes may have only flushed out the weakest hands for a short period of time.

As 2022 has started off to a very strong reception for high-end collectibles, many sectors within the stock market and related “risk assets” like Bitcoin have performed dismally. On this day, the Dow Jones industrial Average (the Dow) was down 1,000 points. That sounds like a crash, but in reality it’s only a 3% move. Still, this is also the seventh straight day of selling. And on this same day, Bitcoin and other digital assets were down over 50% from their highs.

The Dow’s all-time high of 36,952.65 was hit in the first trading days of 2022. On this day the Dow was challenging the 33,150 level mid-day — that is a drop of 10% from the peak, and as of this time it’s only January 24. Still, many of the riskier and high-valued stocks in technology and other great growth areas have seen their prices plummet.

As for the value of your watches, baseball cards, fine art, and so on, a lot of the price will depend on how long this financial turmoil continues. At this time in 2022, investors have a lot of things to consider. The Federal Reserve seems hellbent on raising interest rates to fight inflation, The U.S. and The West are in deep tension over Russia and Ukraine, corporate earnings are generally weaker than expected, and the U.S. and China just cannot seem to get along all that well.

There are a lot of other concerns as well. Hell, Bitcoin almost hit $32,000 and that’s down over 50% just since November’s peak. What matters right here and right now is that “risk assets” are giving way to more conservative assets. This is just one of those periods where it is safer to own things like Treasury bonds, and stocks tied to your utilities and consumer product than it is to own high-flying growth stocks like Amazon, Shopify, Coinbase, DraftKings and all of those speculative special purpose acquisition company (SPAC) shares.

What About Prior Crashes?

Let’s think about some of the more famous stock market crashes…

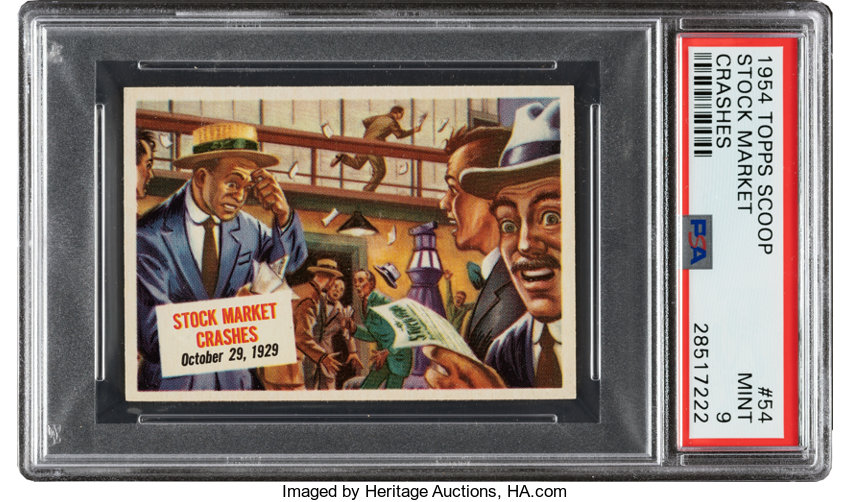

Almost no one alive today was alive during the crash of 1929. That was after great excesses went too far for too long. What could have been a short recession was met with atrocious financial decisions by politicians, the Federal Reserve and by regulators. A quick recession could have been the case, but the tightening policies that were felt and the bank closures helped to make hard times endure for most of the next decade. Executive Order 6102 in 1933 even forced American’s to sell their gold back to the government. It wasn’t exactly boom times until after the end of World War II, more than 15 years after the 1929 crash. Image below by Heritage Auctions.

The 1930s was a difficult time for many boys to think about baseball cards with mass unemployment and bread lines so common. That said, Goudey managed to produce the 1933 set and it enticed buyers with 4 Babe Ruth cards in one set alone. Baseball card collectors who want Babe Ruth owe it all to the 1933 set, but then Goudey followed up with the great “Lou Gehrig Says” set in 1934.

October 19, 1987 was named Black Monday after the Dow fell 508 points, but that represented a 22% drop at the time because the index levels were so much lower. Computerized trading was not as prevalent, but the systems were overwhelmed and they could not handle the volume with panic-selling and with margin calls flooding in. The Federal Reserve helped to add liquidity to the banks and institutions. The stock market crash of 1987 did not bring about long-term economic calamity. Sure, some investors got wiped out and it did take the Dow about 2 years to get back to pre-crash levels.

The year 1987 was during the “Junk Wax Era” but collectibles did ultimately endure after companies like Topps figured out they shouldn’t flood the market with cardboard. Companies like Upper Deck also came into an already crowded scene with its debut in 1989.

The “Dot-Com Bubble” that burst in 2000 was a painful event, but it was limited by and large to “risk assets” when shares of companies like Yahoo!, Amazon, Cisco and the high-flying internet stocks. The tech heavy NASDAQ peaked in March of 2000 and it took more than a decade to get back to even. We also had the added pressure and pain after the 9/11 attacks in 2001, but the drop that was seen in the safer Dow only too until 2006 to get back to even. Many of the top auction houses we know today were around in 2000 and 2001, and many collectibles saw their prices continue to rise at reasonable levels.

The 2008 global financial crisis brought swift pain and the economic response that finally came was swift and forceful. The banks were bailed out after a series of horrible loans, horrible securities created and after asset prices like homes swelled to unsustainable levels. The global financial crisis could have been the next Great Depression had there not been coordinated responses by most major governments. They turned on the printing presses to get cash into the system and the world then got to find out about zero-interest rates. The price for collectibles in this period did not exactly flourish, but collectibles did not crash and prices continued to rise after the financial crisis.

The 2020 COVID-19 pandemic took a whole to set in, but when it came the value of everything crashed. The peak in February of 2020 did not end until that April. March saw two record-setting drops in stocks after the nation began the lock-downs and employers sent every worker home that could work from home. The Federal Reserve went into overwhelming efforts to bail out the public, but this time the banks and large corporation were much better than a decade earlier. All of the cash that was sent to the public and to small businesses to prevent systemic layoffs and shutdowns prevented 2020 from being the end of the global economy as we knew it.

In 2020, the market for collectibles did get soft briefly during the crash but everyone who was stuck at home got back into collectibles. Prices then rose over the course of 2020 and reached a zenith during the first quarter of 2021. Many sports cards have seen their prices plummet as their populations and related number of cards exploded — but many of the rare and scarce collectibles have continued to see record prices.

There are also periods that have been called “Flash Crashes” in the markets. These are very painful when they occur, particularly if investors get stop losses triggered or if they face sudden margin calls. Those instances have nothing to do with the price of collectibles, at least as long as they are not coinciding with the end time of an auction.

All in All…

The scarce assets seem to endure the ups and downs of the economy. Whether or not that will hold true is true after January of 2022 remains to be seen. It is not known just how bad the Russia/Ukraine situation will get. Whatever plays out with the U.S. and China remains to be seen. We all know Washington, D.C. is in disarray. And we know that the government isn’t freely sending checks out at rates that may actually discourage people from working. Consumer prices were up more than 6% at the end of 2021, but the official unemployment rate was back under 4% at the end of 2021.

The market for NFTs and other digital assets is hanging in a difficult spot within collectibles. If these are priced in Bitcoin, Ethereum and others, and if the price in dollars and other currencies have cratered, then it cannot be healthy for those assets.

Collectors Dashboard has warned those who buy collectibles over and over that there is no free-lunch and no one is assured a profit in any asset they buy. If you get no guaranteed profit in stocks and bonds, do you think you are guaranteed a profit in things like fine watches, sports cards, fine art, and even fine wine? The answer is absolutely not!

Goldin.co has also sent out an email that its Holiday Auction has seen over 100 records set in realized prices. It also commanded 64,000 bids, which is shown to be the highest number of bids ever in one of their auctions.

According to the website LiveAuctioneers.com:

In times of uncertainty, objects of value – whether art, gold coins or precious gems – have served as a trustworthy hedge against market volatility. After the stock market crash of 1929, investors with cash reserves knew a long recovery lay ahead and moved their money into gold, rare cars, fine wines, paintings, precious gems and other uncommon goods.

Stock market crashes do occur. They do not all have to be followed by recessions, and it is generally accepted now that the world is just going to have to keep learning how to live with COVID and whatever other pandemics come our way. It also seems likely that we will still be buying baseball cards, comic books, art and so on. At what price remains to be seen.

One last note about stock market crashes. Items signifying those crashes become collectibles in and of their own right.

Categories: Coins & Money, Comic Books, Digital& NFT, Fine Art, Misc., Non-Sports, Sports, Watches & Jewelry, Wine & Whiskey